Blakes Competitive Edge™: August 2023 Update – Antitrust, EU Competition

[ad_1]

To print this article, all you need to do is register or login on Mondaq.com.

Welcome to the August issue of Blake’s competitive edgea monthly newsletter for Plex Competition, antitrust & Foreign investment group. Blake’s Competitive Edge Provides an overview of recent developments in Canadian competition law, including updates regarding enforcement activity by the Competition Bureau of Canada (CCB), recent initiatives and key trends.

the main points

- Merger review activity in 2023 remains slow. With only 13 mergers reviewed in July 2023, this month was less active for merger review than any July in the past decade. On an annual basis to date, the firm has completed just 100 merger reviews through the end of July 2023, which is 23% less than the number completed in July 2022 (130) and 22% less than the number completed in July 2021 (128).

- Bureau entered into an approval agreement with Shell Canada Limited (Shell) to resolve Bureau’s concerns related to Shell’s proposed acquisition of retail gas stations from Sobeys Capital Incorporated.

- The Benchmarking and Statistics report shows a decrease in merger review activity in fiscal year 2022 to 2023 for the firm, but a significant increase in the number of mergers classified as “complex” during the review process.

- Transport Canada publishes its final guidance regarding merger reviews under Section 53.1 of the Act Canadian Transportation Act.

Integration Monitor

July 2023 highlights

- 13 merger reviews have been completed

- Primary industries: real estate, leasing, and leasing (23%); mining, quarrying, oil and gas extraction (15%); manufacturing (15%); Information and cultural industries (15%)

- Seven transactions received a prior judgment certificate (54%); Six transactions received a no-action letter (46%)

January – July 2023 Highlights

- 100 merger reviews completed

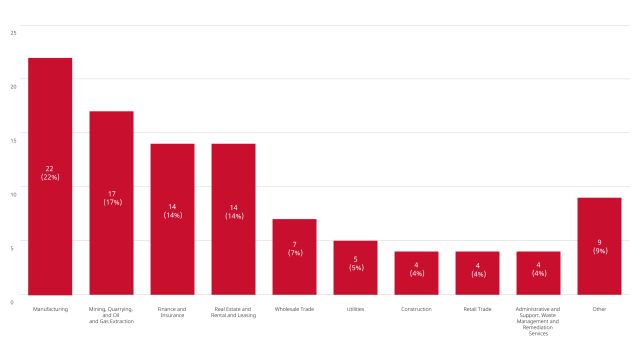

- Primary industries: manufacturing (22%); mining, quarrying, and oil and gas extraction (17%); finance and insurance (14%); real estate, rent and leasing (14%); wholesale trade (7%); Utilities (5%)

- Both consent agreements (treatments) were recorded.

- one judicial decision

- 43 transactions received a pre-judgment certificate (43%); 54 transactions received a no-action letter (54%)

Merger reviews completed year to date in 2023 by primary industry

Merger enforcement activity

The Bureau reaches an agreement of agreement with Shell in relation to its acquisition of the Sobeys gas stations

- On July 31, 2023 Diwan announce that it has entered into an consent agreement with Shell and its affiliates in relation to Shell’s proposed acquisition of 56 retail petrol stations from Sobeys Capital Incorporated. To assuage the Bureau’s concerns that the transaction would significantly reduce competition in supplying fuel to retail customers in Brooks, Alberta and Fort St. John and Mission (including Silverdale), British Columbia, Shell agreed to divest assets related to three retail gas stations.

The office approves the purchaser of Domtar mills associated with the acquisition of Resolute Forest Products Inc.

- On August 2, 2023, The Office consent Dryden Fiber Canada, ULC as the purchaser of Domtar’s pulp mill in Dryden. The bureau also approved Atlas Holdings LLC as the purchaser of Domtar’s pulp and paper mill in Thunder Bay. These divestitures were required by a consent agreement between Domtar and FSO in connection with Domtar’s acquisition of Resolute Forest Products, Inc. For more information about the December consent agreement, see January edition of Plex Competitive Advantage.

non-enforcement activity

Transport Canada publishes guidance regarding merger reviews under Section 53.1 of the Act Canadian Transportation Act

- In July 2023, Transport Canada published Guidelines With respect to its typical process for merger reviews under Sections 53.1 to 53.6 of the Canadian Transportation Act. Article 53.1 Canadian Transportation Act Persons subject to the requirement of prior notice of a transaction are obligated under Competition law (Law) also notify the Minister of Transport (Minister) at the same time about the transaction. These new guidelines are largely consistent with draft guidelines published by Transport Canada in June 2008. The guidelines set out the public interest factors that the Minister will consider during the transaction review and the information that should be included in the public interest impact assessment that the parties are required to provide alongside their other notification materials.

The Competition Bureau issues a performance measurement and statistics report for the fiscal year 2022 to 2023

Office issued Performance measurement report and statistics (PMSR) for the fiscal year 2022 to 2023 (April 1, 2022 to March 31, 2023). Highlights of PMSR include:

- The Bureau received 194 Pre-Merger Notification applications pursuant to Section 114(1) of the Act and Advance Arbitration Certificate (ARC) applications pursuant to Section 102 of the Act. This represents a decrease of 52 applications from fiscal year 2021 to 2022.

- Thirteen requests for supplementary information have been issued pursuant to Section 114(2) of the Act in connection with matters that have been completed. This is significantly higher than in previous years (nine from 2021-2022; 11 from 2020-2021).

- 98.5% of the 128 non-complex merger reviews were completed within the office’s 14-day service standard, down from 100% in 2021 to 2022. The average duration of non-complex merger reviews was 10.06 days in 2022 to 2023, up from 9.12 days. days in 2021 to 2022.

- 92% of the 72 complex integration reviews within the Office’s service standard were completed (45 days or, if a request for supplementary information was issued, 30 days after responses were submitted). This is a decrease from 94.5% in 2021 to 2022. The average review of complex mergers from 2022 to 2023 took 38.75 days, similar to the period from 2021 to 2022, when the average review of complex mergers took 38.39 days.

- 36% of mergers reviewed were rated “complex” from 2022 to 2023, which represents a significant increase from 2021 to 2022, when 24% of mergers reviewed were considered complex.

Section 36 Remedies under Competition Law

The Federal Court ruled that there was no violation of Section 52 in the battery label case

- On July 6, 2023 AD Energizer Brands, LLC v. Gillette Corporation, the Federal Court, in part, allowed the plaintiff Energizer Brands, LLC (Energizer) to proceed against the defendants Duracell Canada, Inc. (Duracell), finding that Duracell’s use of Energizer’s trademarks in comparative advertising on packaging labels was inconsistent with Section 22 of the Code.

Trademark law. However, the Federal Court rejected the plaintiff’s claim under Section 36 of the Law Competition law Based on allegations that Duracell advertisements violate Section 52 of the Act. The posters in question made certain claims regarding the performance of Duracell batteries compared to that of Energizer batteries. Based on several factors, including battery testing evidence submitted to the court, the federal court ruled that there was a reasonable basis for Duracell’s claims about the labels in question, and therefore the claims were not materially false or misleading.

British Columbia Court of Appeal rules that pleading and proof of express reliance is not required in claims under sections 52 and 36 of the Act

- On July 7, 2023 AD Live Nation Entertainment, Inc. against Gomel, the British Columbia Court of Appeal (BCCA) partially allowed the Claimant’s cross-appeal against the certification decision of the British Columbia Supreme Court (BCSC), finding that the BC Supreme Court erred in refusing to certify the Claimant’s claims under sections 36 and 52 of the Act. The plaintiff alleged that the defendants made representations to the public that they offered consumers a fair opportunity to obtain event tickets, prohibited the use of ticket bots and imposed limits on ticket purchases for the purpose of furthering a commercial interest, and that these claims were made knowingly or negligently and were “materially false or misleading.” “, in contravention of Article 52 of the law. The BCSC refused to certify this claim on the basis that the plaintiff failed to plead adverse reliance on these representations. BCCA, relying on Valeant Canada LP/Valeant Canada SEC v. British Columbia, held that a plaintiff need not plead and prove injurious reliance to make a claim under Section 36 of the Act if he pleads another method of proving a causal connection between the alleged breach and any loss suffered. Given that the plaintiff had advanced a general inflationary effect theory of causation which the BCCA found was not doomed to fail, the BCCA held that the BCSC erred in refusing to certify the plaintiffs’ claims under section 36 of the Act on this basis.

Canadian investment law

Non-cultural investments

Highlights

- Related information Canadian investment law Decisions issued since March 2023 have not yet been published and will be addressed in a later edition of Blake’s competitive edge.

Cultural investments

Highlights of the first quarter of 2022

- Four reviewable investment approvals and nine notifications were submitted (six for acquisitions and three for establishing a new Canadian company)

- Investor’s country of origin: United States (62%); China/Hong Kong (23%); Germany (8%); Mexico (8%)

Highlights of the second quarter of 2022

- Two reviewable investment approvals and nine notifications submitted (seven for acquisitions and two for creation of a new Canadian company)

- Investor’s country of origin: United States (64%); Australia (9%); China/Hong Kong (9%); Japan (9%); United Kingdom (9%)

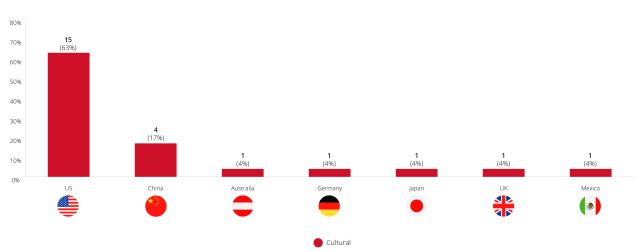

Highlights from Q1 to Q2 2022

- Six reviewable investment approvals and 18 notifications were submitted (13 for acquisitions and five to create a new Canadian company)

- Investor’s country of origin: United States (63%); China/Hong Kong (17%); Australia (4%); Germany (4%); Japan (4%); United Kingdom (4%); Mexico (4%)

Blake notes

For permission to reprint articles, please contact plex Marketing department.

The content of this article is intended to provide a general guide to the subject. It is advised to take the advice of specialists in such circumstances.

Popular articles on: Antitrust/Competition Law of Canada

[ad_2]

Source link